Jun 30 2016

Lundin Mining Corporation is pleased to announce an initial Mineral Resource estimate on the Eagle East mineralization, the results of a Preliminary Economic Assessment and the commencement of access ramp development towards the Eagle East high grade nickel/copper deposit.

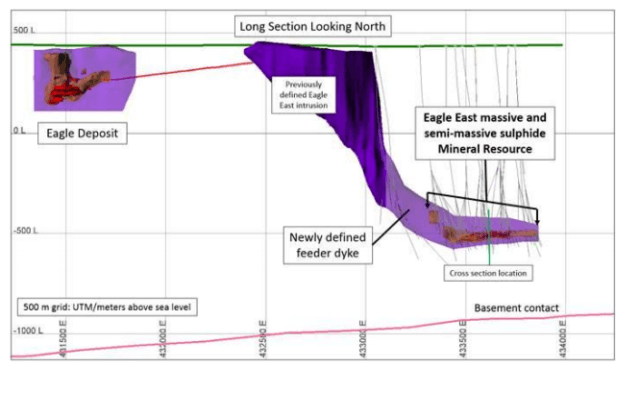

Eagle and Eagle East long section showing exploration drill hole traces and an outline of the Eagle East mineralization

Eagle and Eagle East long section showing exploration drill hole traces and an outline of the Eagle East mineralization

Highlights

- A maiden Eagle East Inferred Mineral Resource estimate of 1.18 million metric tonnes grading 5.2% Ni and 4.3% Cu.

- A PEA completed on Eagle East indicates that these Inferred Mineral Resources can potentially be mined with no significant changes to the current mine, ore transport, mill and tailings disposal infrastructure.

- Similar mining methods to Eagle are proposed and the potential mine production of 1.57 Mt at 3.32% Ni and 2.83% Cu will significantly increase nickel and copper production from 2020 and extend the mine life to at least the end of 2023.

- The estimated pre-production capital cost is $94.8 million.

- The PEA demonstrates the potential viability of mining Eagle East as an extension of the current Eagle mine with an incremental post-tax net present value ("NPV") of $181 million at an 8% discount rate and an internal rate of return ("IRR") of 40%.

- Given the robust results of the PEA, the Company has initiated a Feasibility Study on Eagle East, which is due for completion prior to year-end.

- In parallel, the company has also authorized the commencement of the access ramp development to Eagle East, starting immediately in order to fast track access to the deposit.

- The Eagle East PEA is preliminary in nature and is based solely on Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

Mr. Paul Conibear, President and CEO of Lundin Mining stated, "Our intensive exploration campaign at Eagle East has been a resounding success. The results of the Preliminary Economic Assessment on Eagle East demonstrate significant incremental value and on this basis we have initiated a Feasibility Study and I am pleased to approve the start of access development to the deposit. The successful development of Eagle East will be good news for Eagle employees, local stakeholders and our shareholders alike."

Mineral Resource Estimate

The Eagle East massive and semi-massive nickel-copper sulphide mineralization is located approximately two kilometers east and 600 m below the Eagle mine deposit. Since discovery of the Eagle East mineralization in July 2014, over 35,400 m of diamond drilling have been completed in 67 holes to locate and define the deposit which now has dimensions of approximately 480 m long, 40 to 50 m high and 20 to 25 m wide (see Figures 1 and 2). Sufficient drilling has now been completed to enable the estimation of an initial Inferred Mineral Resource, as tabulated below.

Eagle East, Inferred Mineral Resource estimate, June 29, 2016, NSR cut-off of $141/t

Exploration drilling is continuing in order to define further potential extensions of the mineralization to the north and east. The drilling has also identified another deeper seated target down dip in a vertical gabbro complex below basements rocks and further drilling of this new target is also planned (see Figure 3).

Preliminary Economic Assessment

A PEA has been completed on the Eagle East mineralization which demonstrates the potential viability of mining the Inferred Mineral Resource. Access to Eagle East is planned with a spiral ramp developed from the bottom of the existing Eagle mine, making use of the existing mine infrastructure, and then twin ramps across to the mineralization (see Figure 4). Geotechnical studies completed to date indicate that the same mining method as in Eagle, transverse sub-level stoping with cemented rockfill, can be employed and the potential mine production is tabulated below. To optimize the extraction of this exceptionally high grade mineralization, significant diluting material at zero grade has been included in the preliminary stope designs that have an overall recovery of approximately 85% of the Inferred Mineral Resource. The existing mine infrastructure, power supply, temporary waste stockpiling, water treatment and other facilities are expected to be sufficient to support the mining of Eagle East.

Eagle East, potential mine production, June 29, 2016, NSR cut-off of $160/t

Preliminary testwork has shown that the Eagle East mineralization has similar metallurgical characteristics to that of the Eagle mineralization and that no modifications to the Humboldt processing plant or the current concentrate marketing arrangements will be necessary. Eagle tailings are currently disposed of in the former Humboldt open pit and sufficient capacity exists for the additional tailings volume created by Eagle East.

The use of the existing Eagle mine infrastructure for the mining of Eagle East has also been proposed to minimize the need for new or amended permits. The initial access ramp can be commenced under the existing Eagle permits, and the period required for the full ramp development to Eagle East will allow sufficient time to acquire additional data and apply for modifications to those permits required for the production mining phase.

The PEA has assumed that the access ramp to Eagle East commences in the third quarter 2016 and the first mineralization is available for processing in the first quarter 2020. The high grade mineralization from Eagle East will be blended with the lower grade from Eagle significantly increasing nickel and copper production and extending the mine life (see Figure 5).

The estimated pre-production capital cost for Eagle East is $94.8 million, including a 25% contingency, with the majority of this expenditure for ramp access, ventilation raises, level development and new mine equipment. Mine operating costs have been estimated from the current Eagle contractor rates with allowances for the increased haulage distance, ventilation and dewatering requirements for Eagle East. Processing and G&A costs have been assumed unchanged from current Eagle operations.

The results of the PEA demonstrate the potential viability of mining Eagle East as an extension of the current Eagle mine with an incremental post-tax NPV of $181 million at an 8% discount rate and an IRR of 40% using long term metal prices of $8.00/lb Ni and $3.00/lb Cu. The payback period is approximately one year and the average combined C1 cash cost during the combined Eagle and Eagle East production period is $1.83/lb Ni. The key results of the PEA are tabulated below.

An independently authored National Instrument 43-101 Technical Report on Eagle East will be filed on the Company's SEDAR profile at www.sedar.com within 45 days of this press release.

Commencement of Access Development

Given the robust results of the PEA, the proposed use of the existing facilities at Eagle and the anticipated low risk of developing Eagle East as an extension of Eagle, the Company has initiated a Feasibility Study on Eagle East, which is due for completion prior to year-end.

The company has also authorized the commencement of the access ramp development to Eagle East. The Michigan Department of Environmental Quality has determined that no modifications are required to the mine's Part 632 mining permit at this time. The initial access development will allow the collection of further data in support of the Feasibility Study and future permit applications. Final engineering of the initial ramp design is being completed and it is anticipated that development will commence early in July. Additional capital expenditure for Eagle East above that already budgeted for Eagle is estimated at $12 million to the end of 2016.

Notes on the Mineral Resource, potential mine production estimates and the PEA

The Mineral Resource estimate in this news release has been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), classified in accordance with Canadian Institute of Mining Metallurgy and Petroleum's "CIM Standards on Mineral Resources and Reserves Definitions and Guidelines" 2014.

The Eagle East Mineral Resources and potential mine production estimates have been prepared by or under the supervision of Lundin Mining Qualified Persons as defined in National Instrument 43-101 and audited by independent Qualified Persons on behalf of Lundin Mining.

The Eagle East Mineral Resources and mine production estimates are reported above fixed NSR cut-offs of US$141/t and US$160/t respectively and are dated June 29, 2016. The NSR is calculated on a recovered payable basis taking in to account nickel, copper, cobalt, gold and PGM grades, metallurgical recoveries, metal prices and realization costs. The metal prices used for the NSR calculations are US$8.50/lb nickel, US$2.75/lb copper, US1,000/oz gold, US$1,500 platinum, US$550/oz palladium and US$13.00/lb cobalt. The Inferred Mineral Resources are inclusive of those Mineral Resources modified to produce the potential mine production plan.

The Eagle East PEA study results are only intended to provide an initial, high level summary of the project potential. The PEA is preliminary in nature and is based solely on Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability and there is no certainty that the PEA will be realized.

The Qualified Persons responsible for the Eagle East Mineral Resource and potential mine production estimates are David Rennie, P.Eng., Associate Principal Geologist and Normand Lecuyer, P.Eng., Principal Mining Engineer, respectively, both of Roscoe Postle Associates Inc..

Source: http://www.lundinmining.com/