Mar 9 2021

Bullion Gold Resources Corp. reports that it has signed an Option Agreement with Vantex Resources Ltd. to obtain up to 100% of the Bousquet Property, which is situated on the historical Cadillac Break.

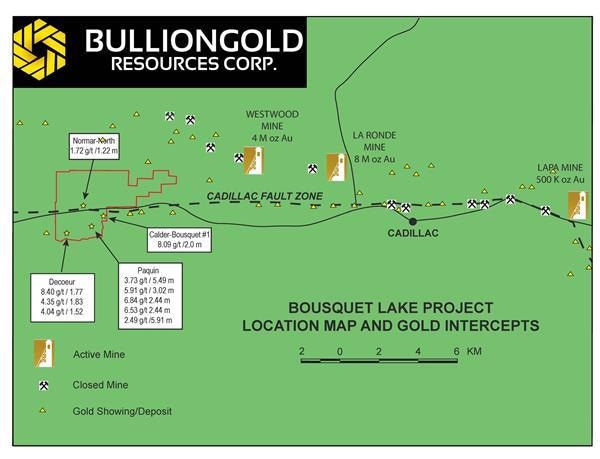

Bousquet Property location. Image Credit: Bullion Gold Resources Corp.

Bousquet Property location. Image Credit: Bullion Gold Resources Corp.

The Bousquet Property includes two claim blocks with 70 claims in total encompassing 1515.55 ha. The property is located in the Abitibi Region of the Province of Québec, nearly 30 km to the west of Rouyn-Noranda.

Meta-sedimentary rocks of the Cadillac, Timiskaming, and Pontiac Groups and from volcanic flows and intrusives of the Piche Group underlie the Bousquet Property. The Cadillac-Larder Lake Break intersects the property for 2.5 km in the Normar Block’s northern part.

There are various gold mines located adjacent to or along the Cadillac-Larder Lake Break that crosses the Bousquet Lake Property. From 1926 to 2020, more than 20 mines have generated over 25 million ounces of gold along the Cadillac Break inside the Bousquet-Cadillac district.

The Cadillac mining camp hosts three types of mineralization associated with unique gold-bearing geological settings: auriferous veins related to regional E-W trending faults (Lapa deposit), gold-bearing massive sulfide lenses (Bousquet 2 and La Ronde mines), and gold-rich polymetallic veins (Doyon and Mouska mines).

In the southern portion of the Bousquet Lake Property, a strong gold mineralized system was found. Three gold showings—Decoeur, Paquin East and Paquin West, and Calder-Bousquet—were identified during the early exploration work (between 1932 and 1945) on the property.

These showings probably formed in the same mineralizing episode inside regional East-West trending faults. Explorations in historical drill holes on the Decoeur showing yielded grades of 4.04 g/t Au over 1.52 m, 8.40 g/t Au over 1.77 m, and 4.35 g/t Au over 4.83 m.

In the historical drilling on the Paquin showings, 6.84 and 6.53 g/t Au over 2.44 m, 5.91 g/t Au over 3.02 m, and 3.73 g/t Au over 5.49 m were yielded. In addition, an intercept of 8.09 g/t Au over 2.0 m was yielded on the Calder-Bousquet gold occurrence.

The gold mineralization is situated in a fold zone above the 250-m level. There is a high probability for the occurrence of other folds from the same deformation at depth or laterally.

The Blackfly group of claims has not been explored much in the past owing to the paucity of outcrops. However, new geophysical methods could help produce valid and good targets from the deposit models of this high-quality location inside one of the most abundant world-class gold belt.

Moreover, gold mineralization was intersected in a 2003 drill program in the felsic intrusion (named tonalite) inside the Cadillac fault zone.

The intrusion occurs between two talc-chlorite schist units of the Piche Group. Hole TMN-03-31 yielded 4.75 g/t Au over 1.5 m in quartz veins, veinlets, and zones of silicification, while hole TMN-03-08 yielded 1.42 g/t Au over 1.5 m and 0.71 g/t Au over 5.7 m gold again in the tonalite.

We are incredibly pleased with this option agreement, which positions us strategically on the Cadillac Fault, a globally recognized gold producing environment. We were attracted by the Property due to the interesting historical showings (Paquin Est, Paquin Ouest and Decoeur) and by the fact that these showings remain open both laterally and at depth. To our knowledge, no depth survey (more than 250 meters) has been carried out on the property.

Jonathan Hamel, President and CEO, Bullion Gold Resources Corp.

Terms of Agreement

According to the terms of the Agreement, Bullion Gold might acquire a 100% interest in 78 claims which form part of the Bousquet Property by fulfilling the following conditions, subject to TSX Venture Exchange approval:

I. Paying a total of $150,000 to Vantex as follows:

- To pay $30,000 upon obtaining the TSX Venture Exchange Approval (or the Effective Date)

- A further $30,000 to be paid on or before the third month anniversary of the Effective Date

- A further $30,000 to be paid on or before the sixth month anniversary of the Effective Date

- A further $30,000 to be paid on or before the ninth month anniversary of the Effective Date

- A final $30,000 to be paid on or before the twelfth month anniversary of the Effective Date

II. Allotting and issuing a total of 1,250,000 Shares to Vantex, as non-assessable and fully-paid, as follows:

- To pay $500,000 on the Effective Date

- A further $375,000 to be paid on or before the sixth month anniversary of the Effective Date

- A final $375,000 to be paid on or before the ninth month anniversary of the Effective Date

Vantex has a 100% interest in the 52 claims found in the Blackfly block and has a 60% interest in the Normar block (18 claims), where the other 40% is owned by Nyrstar N.V. from Switzerland. There are several royalty obligations on the mining claims.