Cobalt plays a vital role in meeting today’s energy demands. It is a key component in lithium-ion batteries, high-performance alloys used in aerospace, and various renewable energy systems. By enhancing the efficiency and durability of modern technologies, cobalt has become increasingly important, particularly with the growing adoption of electric vehicles (EVs), large-scale energy storage, and defense applications.

As demand surges, the cobalt market is shaped by global politics, ethical sourcing concerns, and rapid technological shifts. This article looks at cobalt’s expanding role in industry, focusing on its commercial value, innovations in mining, and the ongoing challenge of balancing sustainability with supply chain security.

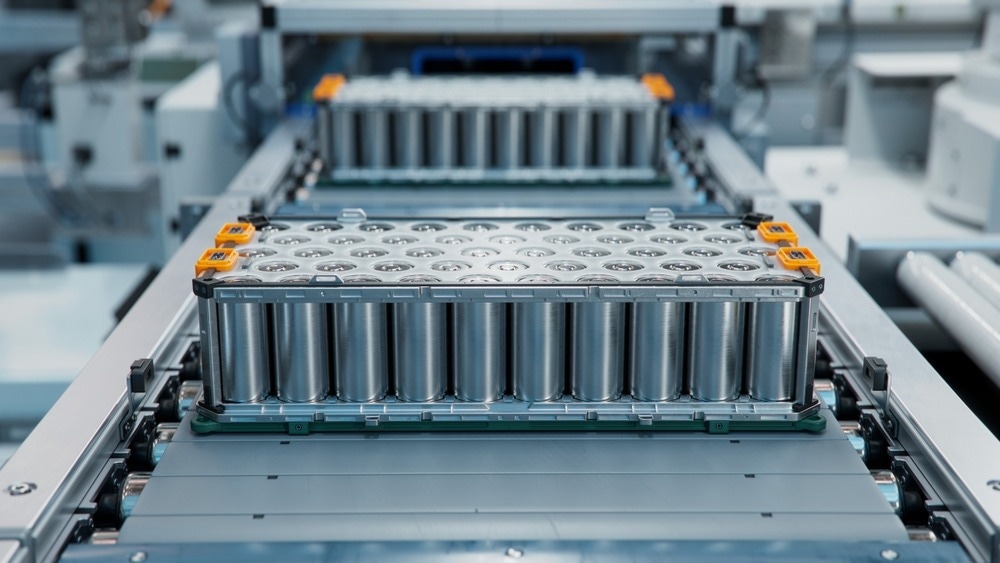

Image Credit: IM Imagery/Shutterstock.com

Global Reserves and Production Dynamics of Cobalt

The Democratic Republic of Congo (DRC) is the biggest producer of cobalt, providing over 70% of the world's supply and holding 60% of the global reserves. In 2024, the world produced more than 300 thousand tons (kt) of cobalt.

The DRC contributed 271.3 kt, while Indonesia produced 20.4 kt and Russia produced 3.1 kt. Indonesia has quickly become the second-largest producer due to Chinese-backed projects that use high-pressure acid leach (HPAL) to extract cobalt from nickel-cobalt laterite deposits. This helps meet the growing demand for EV batteries.1-4

Australia and Canada are relatively small players in the cobalt industry, but they are making efforts to produce environmental, social, and governance (ESG)-compliant cobalt for Western markets.

Projects such as Australia’s Broken Hill and Canada’s Copper Cliff mine aim to reduce dependence on the DRC for cobalt supplies. However, they face challenges due to high production costs and fluctuations in nickel prices, which make it difficult for them to compete. At the same time, Russia’s cobalt production has been limited by sanctions related to the conflict in Ukraine, underscoring the risks associated with having supply chains concentrated in specific regions.1,4

Ethical and Environmental Challenges in Cobalt Mining

Artisanal and small-scale mining (ASM) accounts for 15–30% of the DRC’s cobalt production, often involving hazardous working conditions, child labor, and environmental degradation.

Documentaries like Cobalt Rush – The Future of Going Green highlight the human cost behind “green” technologies, where miners risk their lives in makeshift tunnels.5,6

To address these issues, the European Union’s Critical Raw Materials Act (CRMA) requires companies that buy cobalt to assess their ESG risks.

Programs like the Responsible Minerals Assurance Program (RMAP) push for better tracking of cobalt. Companies like Ford and Tesla are using blockchain to follow cobalt from the mine to the battery, and they audit their suppliers to ensure they meet ethical standards. However, progress remains slow as only 20% of industrial mines in the DRC are fully compliant with international labor norms.1,2,5,6

Environmental issues are also significant. Open-pit mining in the DRC causes soil acidification and water contamination, while HPAL projects in Indonesia create a lot of waste. New methods like bioleaching and hydrometallurgical recycling could help reduce environmental damage, but scaling these solutions remains a challenge.2,6

Technological Innovations in Cobalt Extraction and Recycling

The cobalt extraction and recycling landscape is rapidly evolving, driven by technological innovations that enhance efficiency, safety, and sustainability in response to the growing demand from EVs.

AI and Automation

Mining giants like Glencore and CMOC use artificial intelligence (AI)-driven exploration tools to identify cobalt-rich deposits. Drones and remote-operated machinery are increasingly used in the DRC’s hazardous mines to improve safety and efficiency. Automated haulage systems and real-time data analytics were recently deployed in CMOC’s Tenke Fungurume mine to optimize ore processing.1,2,6

Recycling Breakthroughs

Recycling EV batteries is also critical to offset primary demand. By 2040, 14 million EV batteries are expected to reach end-of-life. Companies like Redwood Materials have developed hydrometallurgical methods to recover 95% of cobalt from old batteries. The EU has a new regulation that requires a 70% recovery rate for cobalt by 2030, which is pushing investments in circular economy models.5,7

HPAL Advancements

In Indonesia, projects like Weda Bay and Sorowako utilize HPAL technology to extract cobalt from low-grade nickel laterites. This method, though energy-intensive, reduces reliance on traditional copper-cobalt ores and aligns with China’s strategy to control battery supply chains.3,4

Cobalt’s Shifting Demand in Battery Chemistries

Cobalt is essential for developing high-energy batteries such as Nickel Manganese Cobalt Oxide (NMC) and Nickel Cobalt Aluminum Oxide (NCA). However, its use is going down because of costs and ethical issues. Lithium iron phosphate (LFP) batteries, which do not use cobalt, now make up 34% of the EV market, up from 6% in 2020. Tesla’s Model 3 and BYD’s Seagull are examples of this shift, prioritizing affordability and thermal stability over range.8

Click here to download this article for later reading

However, cobalt is still needed in aviation, defense, and large-scale energy storage, which keeps demand steady. NMC batteries remain popular in higher-end EVs, and cobalt-based superalloys are essential in jet engines like the GE9X. The U.S. Department of Energy projects cobalt demand to grow at 8.53% CAGR through 2035, driven by the aerospace and renewable energy sectors.6,7

Geopolitical Tensions and Market Volatility

China controls 80% of the world's cobalt refining capacity, and its strategic investments in the DRC and Indonesia have raised concerns for the West. The US has placed a 25% tariff on Chinese cobalt, leading car companies like GM and Ford to seek partnerships with Australian and Canadian miners.1,4

In 2025, the DRC plans to suspend exports to stabilize prices. This decision shows how fragile the market can be. After the ban, cobalt prices jumped 69% in the first quarter of 2025, but there is still an oversupply, with a forecasted surplus of 21,000 metric tons this year. Meanwhile, cobalt from Indonesia, often produced in plants owned by Chinese companies, could avoid US tariffs, reshaping trade dynamics.4,8

Balancing Innovation and Sustainability

As the demand for energy storage grows, balancing innovation with sustainable practices is crucial. Companies like Toyota and QuantumScape are leading the development of solid-state batteries, significantly reducing cobalt content by 50% and utilizing sulfide electrolytes to achieve higher energy density.7

Meanwhile, firms such as The Metals Company are exploring deep-sea mining in the Clarion-Clipperton Zone, where polymetallic nodules boast cobalt grades four times greater than those found on land. However, environmental concerns are hindering commercial extraction. The Cobalt Institute's “Cobalt for Development” program aims to improve artisanal mining conditions through partnerships with NGOs, while the EU’s CRMA promotes transparency in sourcing.2,6

Conclusion

Cobalt plays a crucial role in reducing carbon emissions, but there is an urgent need to focus on ethical and sustainable practices. Although recycling and new technologies might reduce the demand for cobalt, it is still essential in aerospace, defense, and high-performance EVs. For the mining industry, success will depend on leveraging AI, embracing circular economies, and fostering equitable partnerships with resource-rich nations. As the push for cleaner energy continues, cobalt remains a catalyst for progress and a test of humanity’s ability to balance innovation with responsibility.

References and Further Reading

- The global cobalt market: outlook to 2030. (2025). Mining Technology. https://www.mining-technology.com/features/the-global-cobalt-market-outlook-to-2030/

- Cobalt Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2030. (2024). Market Research Reports & Consulting | GlobalData UK Ltd. https://www.globaldata.com/store/report/cobalt-mining-market-analysis/

- Global cobalt mining: an outlook to 2030. (2025). Mine https://mine.nridigital.com/mine_apr24/cobalt-mining-outlook-2030

- How global copper, nickel markets will drive the outlook for cobalt in 2025. (2024). Fastmarkets. https://www.fastmarkets.com/insights/how-global-copper-nickel-markets-will-drive-the-outlook-for-cobalt-in-2025/

- Beneath the surface: the human and environmental cost of cobalt mining. CETEx. https://cetex.org/publications/beneath-the-surface-the-human-and-environmental-cost-of-cobalt-mining/

- Cobalt Is The Critical Component Powering Our Future. Zimtu Capital Corp. https://www.zimtu.com/cobalt-the-critical-component-powering-our-future/

- Cobalt Market Size, Share & Global Industry Report 2035. Market Research Future - Industry Analysis Report, Business Consulting and Research. https://www.marketresearchfuture.com/reports/cobalt-market-6549

- Cobalt Market Update: Q1 2025 in Review. NASDAQ. https://www.nasdaq.com/articles/cobalt-market-update-q1-2025-review

Disclaimer: The views expressed here are those of the author expressed in their private capacity and do not necessarily represent the views of AZoM.com Limited T/A AZoNetwork the owner and operator of this website. This disclaimer forms part of the Terms and conditions of use of this website.