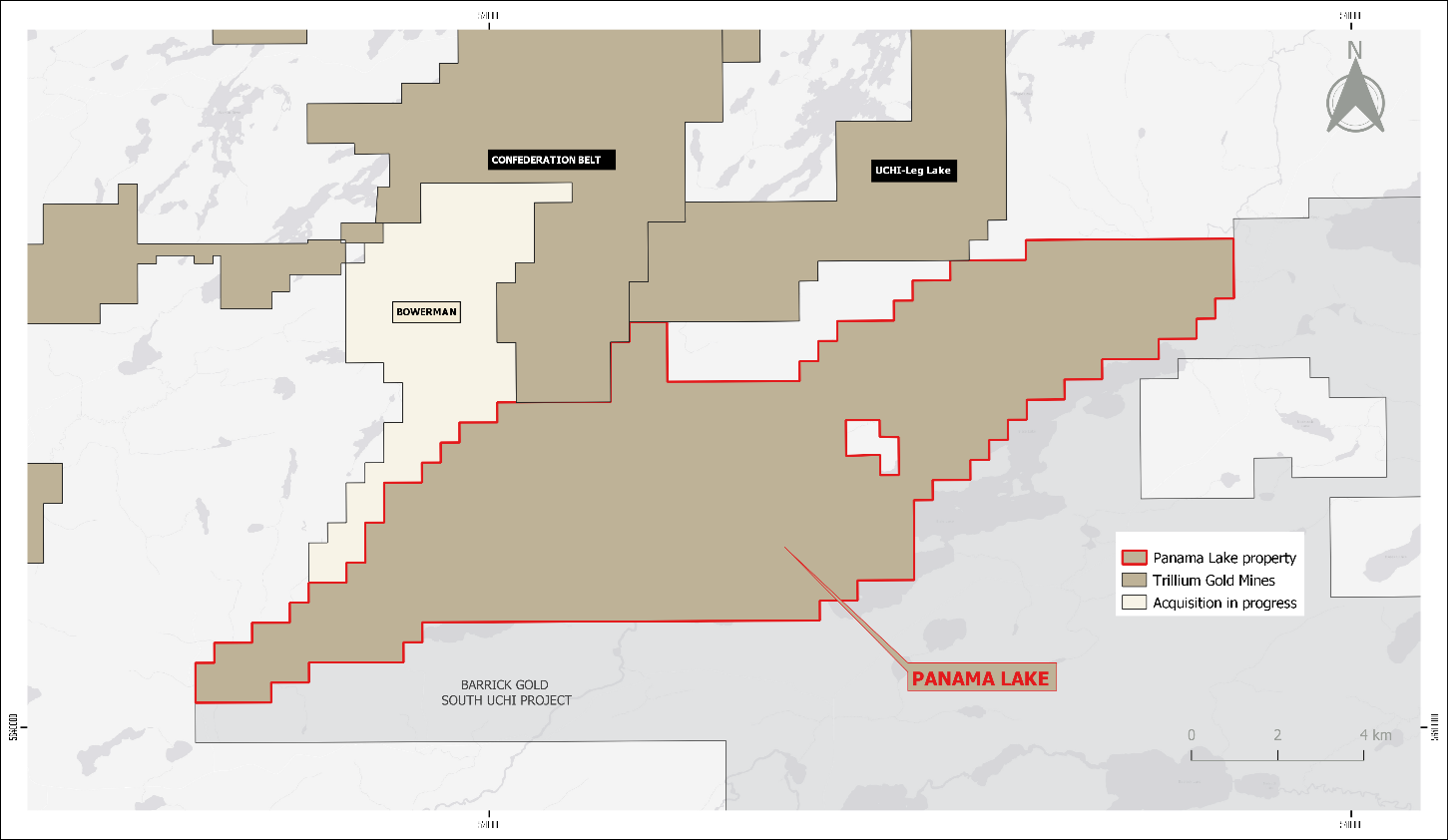

Map showing Trillium Gold’s Panama Lake Gold Project. Image Credit: Trillium Gold Mines Inc.

The Panama Lake Gold Project is situated around 80 km from and on the same structural trend as Kinross Gold’s LP Fault Zone and efficiently expands Trillium Gold’s dominant contiguous foothold together with the Confederation belt by 9,882 hectares.

According to the Assignment and Assumption Agreement entered into pursuing the closing of the Purchase Agreement (the “Assignment Agreement” together with the Original Option Agreement, the “Option Agreement”) between Trillium Gold and St. Anthony Gold, St. Anthony Gold has appointed all of its obligations and rights under the Original Option Agreement to Trillium Gold.

Besides, in accordance with the Assignment Agreement, Benton Resources Inc has decided to register 100% of the property title to Trillium Gold, while keeping back its 50% ownership interest in the property until such time as Trillium Gold addresses its option to earn 100% interest.

With the recently completed acquisition of the Eastern Vision properties, the Panama Lake acquisition brings Trillium Gold’s consolidated land package along the Confederation Belt to over 58,400 hectares, bound by the Red Lake and LP Fault structures, positioning it as one of the most prospective exploration projects in the heart of the Red Lake mining district.

Russell Starr, President & CEO, Trillium Gold Inc

The geological group of Trillium has started early exploration work while permit applications for trenching and drilling are in progress and are anticipated to be received in early summer 2022. The company has scheduled an initial 6,000 m of drilling across the project area on targets that have been researched in a systematic manner and have been deemed and prioritized drill ready.

Terms of the Panama Lake Agreement

As per the terms of the Purchase Agreement, which has since been revised after the news release that was circulated on June 1st, 2022, Trillium Gold paid St. Anthony Gold, Cdn $500,000 in cash and released 1,000,000 common shares in the capital of Trillium Gold.

In the case Trillium Gold obtains a 100% interest in the Property, St. Anthony Gold might result in Trillium Gold exercising its Buy-Back Right under the Option Agreement to repurchase from Benton Resources one-half of the 2.0% Net Smelter Royalty on the property and convey such buy back 1.0% NSR to St. Anthony Gold in switch for a cash payment by St. Anthony Gold to Trillium Gold of $1,000,000.

In line with the terms of the Option Agreement, for Trillium Gold to earn around 70% interest in the property, it will pay Benton Resources Cdn $100,000 in cash by October 24th, 2022, and finish Cdn $250,000 in exploration expenditures on the Project by April 24th, 2023.

Trillium Gold holds the option to earn almost 100% ownership of the property by paying Benton Resources an additional Cdn $300,000 in cash and full Cdn $300,000 in exploration expenditures on the Project in every case by October 24th, 2023.

Benton Resources holds the right to keep a 2.0% NSR on the Project, subject to the option of Trillium Gold to get back one-half of such royalty (being 1.0%) for Cdn $1,000,000.

In the case that Trillium Gold finishes a NI 43-101 compliant resource estimate for the Property, Trillium Gold will be paying Benton Resources a cash payment that has been fixed depending on the number of ounces of gold in the NI 43-101 report multiplied by $0.50.

The Common Shares of Trillium Gold that have been issued under the Purchase Agreement are subject to a four-month holding period from the closing date. The Purchase Agreement is considered subject to the approval of the TSXV and other applicable regulatory authorities.

About the Panama Lake Property

Since the late 1960s, a long history of exploration activity has happened on the Panama Lake Gold Project.

Recent diamond drilling finished by Benton Resources and St. Anthony Gold has remained to stop anomalous gold values from the Panama Zone and north of a highly anomalous gold grain till sample gathered by the Geological Survey of Canada (GSC Open File 3038).

A newly finished interpretation of newly obtained airborne geophysics has determined various linear magnetic trends that seem coincident with the Panama Zone and other gold occurrences that have been discovered on the Panama Lake Gold Project.

This new geophysical interpretation and anomalous gold values that have been recently acquired from the 2019-2022 diamond drill programs will enable future exploration programs to be concentrated on regions of high mineral potential.