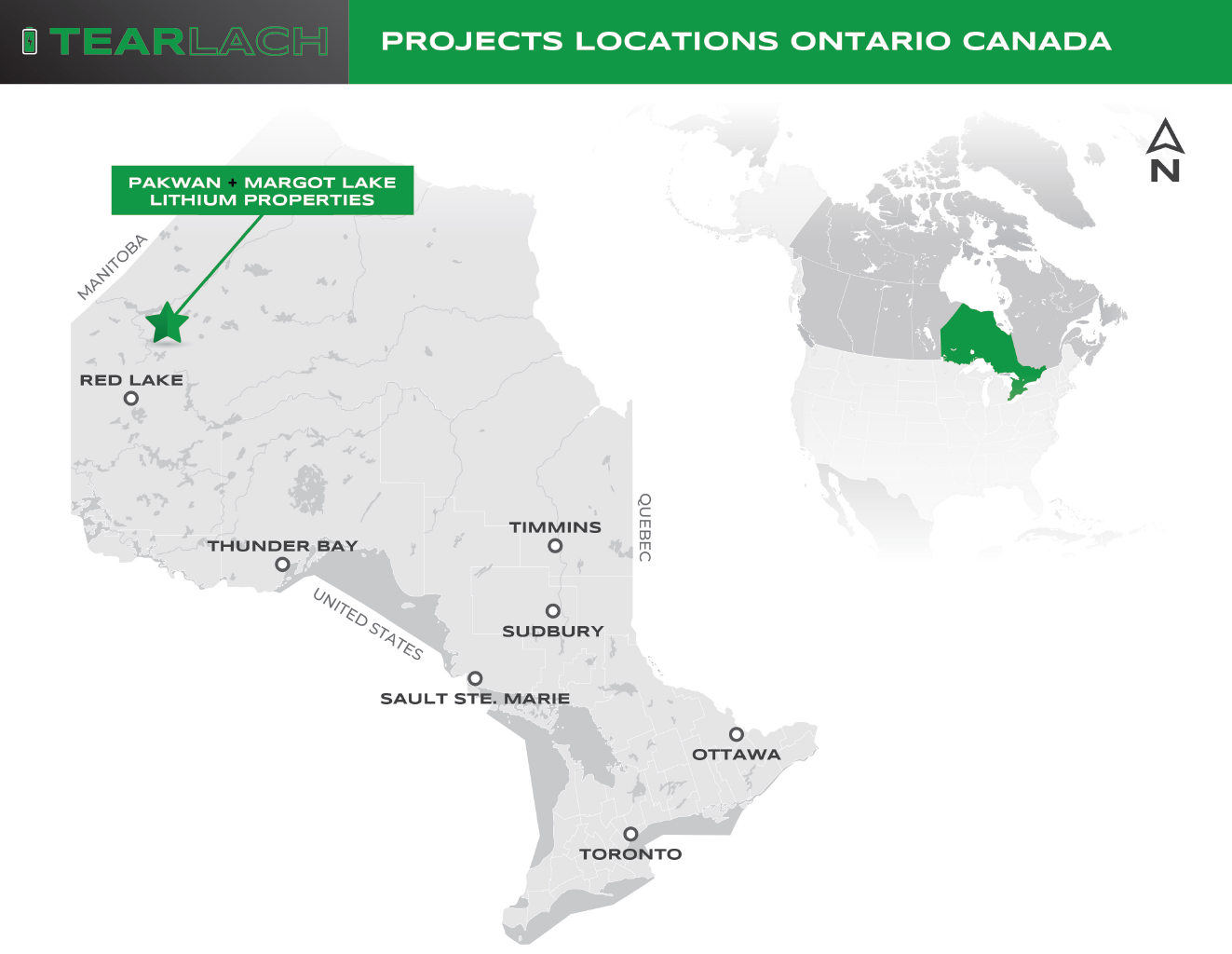

Tearlach Lithium Projects along the ‘Electric Avenue’. Source Frontier Lithium. Image Credit: Tearlach Resources Limited

The PAK and Spark Deposits are housed in Frontier Lithium’s “Electric Avenue,” where the projects are situated. Mineral resources in the 9.3 Mt (million tons) measured, indicated, and inferred categories, averaging 2.06% Li2O, are present in the Pak Deposit.

Mineral resource estimates for the Spark Deposit are 14.4 Mt, averaging 1.4% Li2O. Frontier Lithium also made two additional important pegmatites along strike, the Bolt and Pennock.

The Pakwan Project

- Very favorable terms due to strong relationships through advisors and board members

- Potential for new discovery in the area

- Documented pegmatites

- 1271 hectares of lithium potential claims in the correct geological setting documented pegmatites

- Directly attached to the Frontier Lithium Pak and Spark deposits claim blocks

The Margot Lake Project

- 2706 hectares of lithium potential claims in the correct geological setting with documented pegmatites

- Directly attached to the Frontier Lithium Pak and Spark deposits claim blocks

- Hosted within 10 km of the Pak and Spark deposits

- Off a structural splay called the Bear Head Deformation Zone that the Pak and Spark deposits sit on

- Splay is under-explored

- Potential for new discovery in the area

- Very favorable terms due to strong relationships through advisors and board members

Adding to an already exciting portfolio, the Pakwan and the Margot are located in the most prolific lithium mining trends in the Americas. The Projects are in a region with multiple discoveries, favorable geology, proven metallurgy, and most importantly, on-trend and next to one of the highest-grade lithium projects in the Americas.

Ray Strafehl, Chief Executive Officer, Tearlach Resources Limited

Strafehl added, “This acquisition is just the start of the next phase of how Tearlach is utilizing its world-class team in selecting high-potential projects and making smart acquisitions that are shareholder friendly. This acquisition puts the Company on a trajectory of proving it can become one of the leading lithium companies in the Americas.”

The Pakwan

The Pakwan consists of 51 claims totaling 1,271 hectares. Along the line separating the Sachigo Subprovince from the Berens River Subprovince is where the Pakwan can be found.

Significantly, the Li deposits of northwest Ontario are close to sub-provincial borders since they represent deeply seated sutures that separate accreted Archean terranes and serve as conduits for fertile peraluminous granitic melts (Breaks et al., 2003).

Nine major plutons of two mica granites (peraluminous fertile granites) occur over 140 km of strike length along the subprovince border in the Bear Head Deformation Zone (BHDZ), which transects the Pakwan and is a structural feature at the crustal scale.

Li-bearing pegmatites are fractionated from peraluminous fertile granites, which are the parent rocks (Breaks et al., 2003). Within 12 km to the southeast of Frontier Lithium’s PAK Lithium Deposit is the Pakwan. Map M2362, 1977, produced by the OGS, shows pegmatites on the project.

The Margot

There are 102 claims totaling 2,706 hectares in the Margot. The Margot is housed along the BHDZ’s structural splay. A two-mica peraluminous granite in contact with metasediments is present in the Margot. Pegmatitic dykes on the project have been identified through mapping by the OGS in map P3283, 1994.

The Transaction

According to the purchase agreement, Tearlach could purchase a 100% interest in the Pakwan and Margot Projects from independent vendors by paying, per project, $200,000 at the time of the purchase agreement’s signing and $100,000 in year 2, as well as $2,000,000 upon the successful drilling of 10 m containing 1% or more Li2O.

A half-percent buyback for $1 million will be offered by the vendors on their 3% net smelter royalty (the “NSR”) on the projects. According to the rules of the TSX Venture Exchange, the Purchase Agreement qualifies as an “Exempt Transaction.”