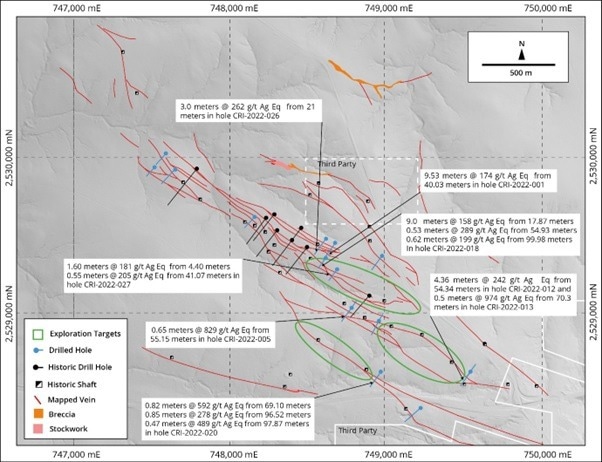

Map of El Cristo showing Zacatecas’ drill hole traces in blue. Historical drill hole traces are also shown (black). The base of the map is a grey scale digital elevation model. Image Credit: Zacatecas Silver Corp.

The El Cristo vein system is the NW strike extension of the prolific and renowned Veta Grande vein system, which has reported, but unverified, historical production of 200 Moz AgEq.

The company plans to follow up with an extra 25000 m diamond drill program to extend the deposit at depth and along the strike. Deposit modeling and petrographic study performed by the company denotes that El Cristo is of the same style of mineralization as the Veta Grande.

The El Cristo vein system consists of a strike length of more than 3 km on the company licenses and several veins developed within a dilation jog up to a width of 650 m.

The high-grade silver-base metal mineralization was historically mined from at least 31 shallow vertical shafts, reflecting the El Cristo vein system's highly prospective nature and high-grade silver-base metal mineralization next to the surface.

The 28 holes drilled by the company were scout holes developed to test the near-surface depth extension of select veins for over at least 2 km of strike extension.

Silver-base metal mineralization was sectioned in 22 out of 28 drilled holes. Importantly, high-grade silver equivalent mineralization was sectioned very close to the surface (from 20 to 100 m downhole) over downhole widths of up to 9.3 m. Based on these results, the company has determined three high-priority regions to test strike and depth extensions of several veins.

This exploration at the silver project has been planned besides the exploration plans that have been recently declared at the Esperanza Gold Project and advancing the Preliminary Feasibility Study (“PFS”) at that project.

The company is making arrangements for a non-brokered private placement financing of 7,777,778 units for $0.45 per Unit for total proceeds of $3,500,000 (the “Offering”). Every unit will comprise one common share; and one common share purchase warrant. Every Warrant will authorize the holder to purchase a Common Share at an exercise price of $0.55 for three years or months from the issue date.

The securities under the offering will be subject to limitations on resale expiring four months and the day after issue. The company might pay registered finders a fee in cash and/or share purchase warrants.

The Company plans to utilize the net proceeds of the offering to additionally progress studies at the Esperanza Gold Project, exploration activities at the silver projects, and normal working capital purposes.