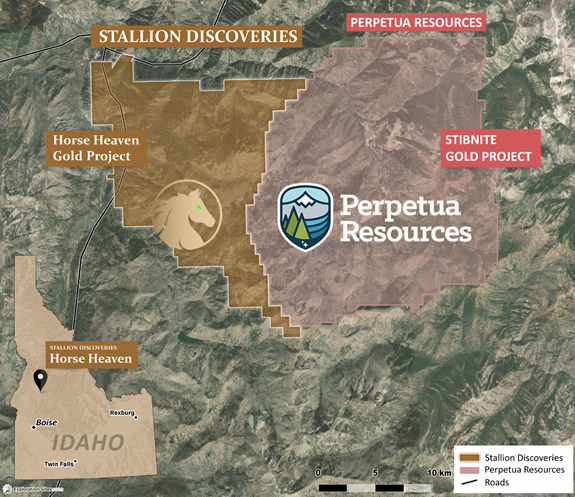

Horse Heaven Project borders Perpetua Resources. Image Credit: Stallion Discoveries

Horse Heaven Holdings Inc. is solely owned by Horse Heaven Parent (Horse Heaven Nevada). Horse Heaven Nevada owns 100 percent of the Horse Heaven Project (Project).

The Project consists of 699 mining claims spanning 14,374 acres in Valley County, Idaho, and shares its entire eastern boundary with Perpetua Resources’ Stibnite Gold Project. Perpetua Resources’ mission is to supply the United States with a local source of the vital mineral antimony, as well as to build one of the country’s largest and highest-grade open pit gold mines and to repair an abandoned brownfield site.

The US Forest Service revised the Project’s permitting timeline, with a Final Environmental Impact Statement and drafts Record of Decision expected by the end of 2023 and a Final Record of Decision expected in early 2024.

The work we have done at Horse Heaven gives our team high confidence in the potential for a significant discovery of both Gold and Antimony. Our belief in the Horse Heaven project comes from our own geological work, but when combined with the continued advancement of the Stibnite Project by Perpetua Resources right next door, we believe this area will be one of the most exiting gold and critical mineral districts in the US.

Drew Zimmerman, CEO, Stallion Discoveries

The Golden Gate Fault Zone and the Antimony Ridge Fault Zone are two of the Project’s previous exploration zones. The Horse Heaven project’s current exploration focus is along the 3 km Golden Gate Fault Zone (GGFZ), which holds gold and tungsten mineralization.

Stallion has advanced the GGFZ with a 789-sample geochemical study in 2021 that revealed structurally controlled anomalous gold and a CSAMT geophysical survey across the entire zone in 2022.

This work, together with past drilling results of up to 1.51g/t over 36 m, gives Stallion considerable confidence in the presence of substantial gold mineralization along the Fault Zone. The team has designed a 19-pad drill program to test the fault zone and is currently negotiating drill permission with the USFS.

Exploration at Antimony Ridge will concentrate on the area where antimony was formerly mined and will include geological mapping, rock, and soil sampling to determine whether and where a prospective geophysical survey would be advantageous.

Antimony is classified as a pivotal mineral in the United States, and efforts to identify significant occurrences of strategic minerals with no domestic production cannot be overlooked, particularly given the Department of Defense’s recent inclusion of antimony as a defense shortfall material and inclusion in the Homeland Acceleration of Recovering Deposits and Renewing Onshore Critical Keystones Act (HARD ROCK Act), a bipartisan bill to boost domestic production. released on June 14th, 2022.

Stallion believes the property is largely unexplored and that, in addition to the two historical zones, several potential prospects for further research have been found. The Project provides year-round road access, is close to electrical transmission lines, has adequate water rights, and is adjacent to a state-maintained 1,000 m airstrip.

The Horse Heaven project’s present approach involves low continuous capital investment while having upside potential due to the advancement of the neighboring Stibnite Project, one of the largest, high-grade independent gold mines in the United States. The approval of the Stibnite project would add enormous value to the area.

The Company has completed its last payment of CAD$400,000 and issued 12,000,000 common shares in order to acquire a 100% interest in Horse Heaven Parent under the terms of the Agreement. Over a two-year period, the Company paid a total of CAD$1,200,000 and issued a total of 36,000,000 common shares. All shares issued under the Agreement are subject to a four-month and one-day hold period from the date of issuance.