Image Credit: Q2 Metals Corp.

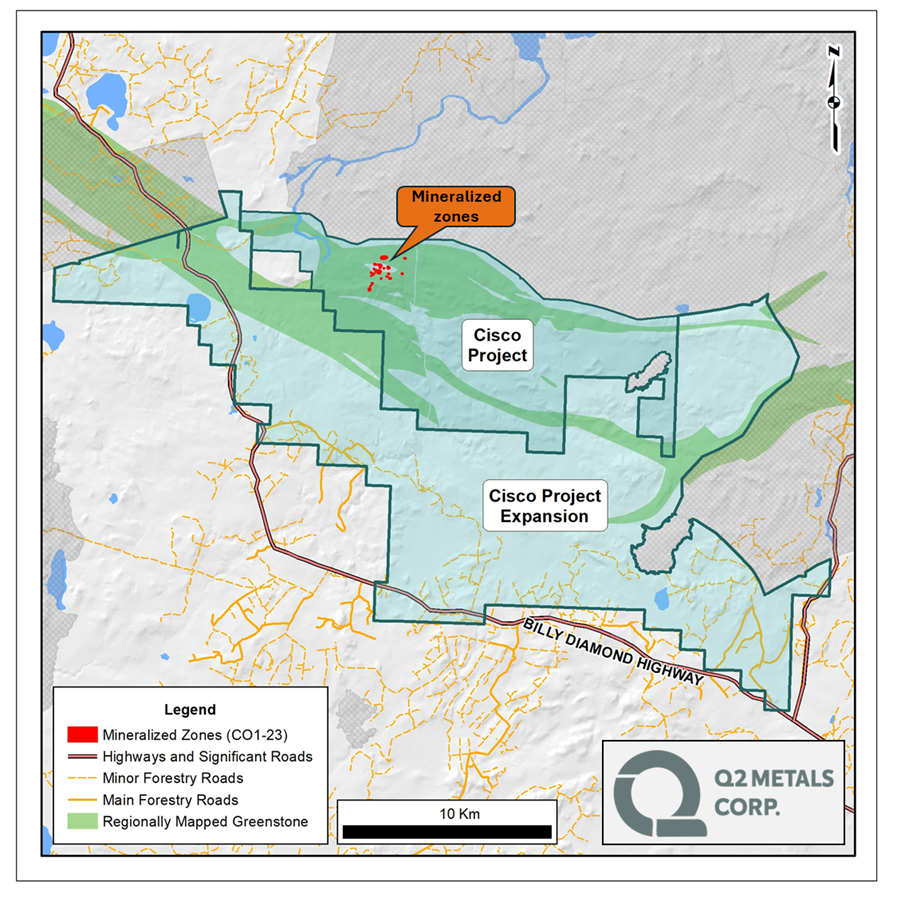

The Cisco Property is now comprised of a total of 767 contiguous mineral claims over 39,389 hectares ("ha"), including more than 30 kilometres ("km") of strike length on the Frotet-Evans Greenstone Belt, which hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively. The Additional Cisco Claims are primarily south of the original Cisco Property claims, adding several kilometres of prospective greenstone rocks and providing extensive strategic sites for future development and mining infrastructure scenarios.

Neil McCallum, Vice President of Exploration for Q2 stated, " While we eagerly await the pending release of remaining assay results from the lab, we have been focused on planning our winter 2025 exploration program. These additional claims add a tremendous amount of mineral prospectivity at Cisco as they include more of the greenstone belt that has been our focus this year and which has yielded such tremendous success. As we approach year end, we're looking forward to further updates and a very busy 2025. "

Additional Cisco Claims - Acquisition Terms

The Additional Cisco Claims were acquired pursuant to an option agreement dated November 26, 2024, between Q2 Metals, 9490-1626 Quebec Inc. (" CMH ") and Anna-Rosa Giglio (together with CMH, the " Vendors ").

To acquire the Additional Cisco Claims,the Company must pay to CMH an aggregate of $2,400,000 over a period of 42 months and complete $1,200,000 of exploration expenditures during that time:

| Closing date |

$150,000 |

|

| 3 Month Anniversary of Closing Date |

$150,000 |

|

| 6 Month Anniversary of Closing Date |

$300,000 |

|

| 12 Month Anniversary of Closing Date |

$300,000 |

$335,000 |

| 18 Month Anniversary of Closing Date |

$300,000 |

|

| 24 Month Anniversary of Closing Date |

$300,000 |

$325,000 |

| 30 Month Anniversary of Closing Date |

$300,000 |

|

| 36 Month Anniversary of Closing Date |

$300,000 |

|

| 42 Month Anniversary of Closing Date |

$300,000 |

$540,000 |

| Total |

$2,400,000 |

$1,200,000 |

Upon satisfaction of the above payments and expenditures, the Company will earn a 100% interest in the Additional Cisco Claims.

The Vendors will retain a 3% gross metals returns royalty (the " GMR ") on the Additional Cisco Claims except the Soquem Claims (as defined below), of which up to 2% of the GMR may be purchased by the Company at any time prior to commercial production for $1,000,000 on the first 1% and $2,000,000 on the next 1%. The foregoing GMR purchase payments may be satisfied in either cash or Common Shares, at the election of the Company and subject to regulatory approval. Certain of the Additional Cisco Claims (the "Soquem Claims") bear a 2% net smelter returns royalty (the " NSR ") in favour of Soquem Inc. Upon closing, the Company will assume the rights and obligations under the NSR, which include the right to repurchase 1% of the NSR for $500,000. In addition, the Company will grant the Vendors a 1% GMR on the Soquem Claims. The Vendors will also be paid a bonus of $2,500,000 on the completion and delivery of an initial mineral resource calculation report, prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, on the Additional Cisco Claims demonstrating an inferred resource (or higher category) of at least 25 million tonnes grading over 1% Li2O. Closing of the Agreement is subject to certain terms and conditions.

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by NI 43-101 and has reviewed and approved the technical information in this news release. Mr. McCallum is a director and VP Exploration for Q2.