GoldHaven Resources Corp. ("GoldHaven" or the "Company") has finalized an agreement to acquire the Hamel claims ("Claims") situated in northwestern British Columbia, within the Magno Project area of the Company. The newly acquired Claims encompass an area of 429.46 hectares and further illustrate GoldHaven’s dedication to consolidating its extensive land position in this highly promising region.

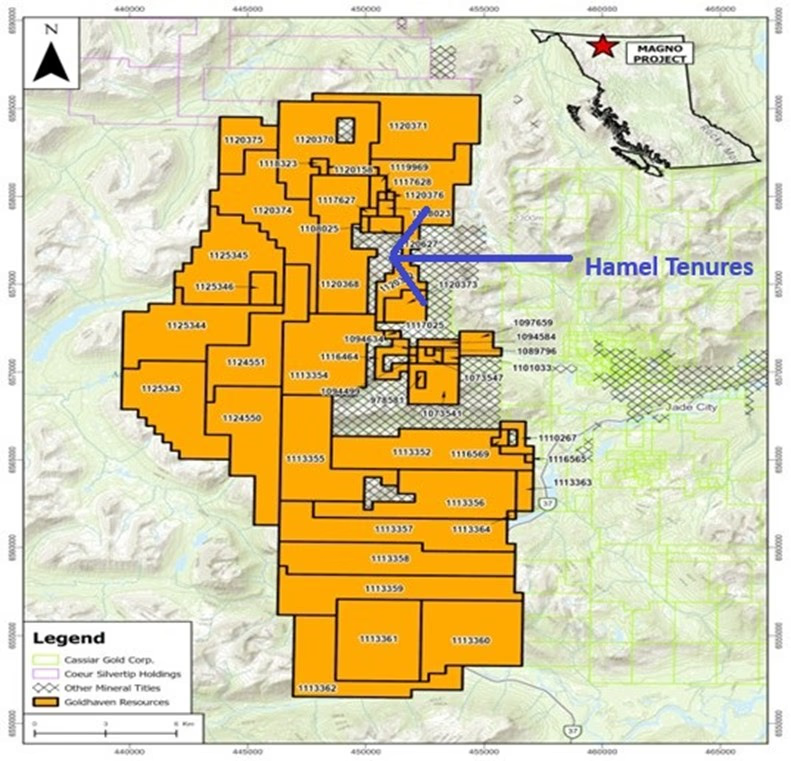

Location of Hamel tenures located within GoldHaven’s Magno project in Northern BC. Image Credit: GoldHaven Resources Corp.

Location of Hamel tenures located within GoldHaven’s Magno project in Northern BC. Image Credit: GoldHaven Resources Corp.

The Magno Project encompasses various styles of mineralization that are interconnected through shared fluid pathways and heat sources, indicating a sequence of related mineralizing events. Recent field investigations have pinpointed the Cassiar Stock – a 72 Ma Cretaceous granite located along the eastern margin of the Cassiar Batholith – as a significant factor influencing mineralization.

Mapping has established a robust correlation between the phases of the Cassiar Stock and the mineralized occurrences, leading GoldHaven to extend the project area to 36,002.99 hectares to consolidate the system. Initial studies have linked mineralized skarns along north–south and northeast-trending structures where the Cassiar Stock intrudes into the sediments of the Cassiar Terrane.

At Magno Central (comprising the Magno and D zones), skarn and CRD-style mineralization that is structurally controlled is found within the Rosella Formation, which has historically been recognized for Ag-Pb-Zn but is now revealing potential for indium and gallium. Comparisons with Coeur Mining’s Silvertip Project underscore significant regional potential, while mapping in the Kuhn and Dead Goat zones has revealed skarns primarily composed of diopside–garnet, along with areas containing tremolite, pyrrhotite, and scheelite.

Terms of the Agreement

GoldHaven has executed a title transfer agreement ("Agreement") with Robert Joseph Hamel ("Vendor"), whereby the Company will acquire a 100 % interest in the Claims located in the Cassiar Mining District, British Columbia ("Transaction").

In exchange, GoldHaven will provide $10,000 CAD in cash and issue 300,000 common shares ("Consideration Shares") to the Vendor. All Consideration Shares will be subject to a standard four-month hold period as mandated by Canadian law.

The acquisition of the Hamel claims strengthens our strategic land position within the Magno Project and underscores our commitment to building a district-scale mining portfolio in British Columbia. We believe this area holds strong exploration potential, and consolidating key ground positions is an important step in unlocking value for our shareholders.

Rob Birmingham, President and CEO, GoldHaven Resources