Australian copper producer and explorer Austral Resources Australia Ltd (“Austral”) has secured binding commitments for a $40 million placement that positions the Company to complete its balance sheet recapitalization, integrate recent acquisitions, and move towards re-quotation on the ASX.

The capital raise, comprising approximately 800 million new fully paid ordinary shares at $0.05 per share, drew strong support from institutional and sophisticated investors.

Chairman David Newling said the successful placement marks a major milestone in Austral’s transformation:

“This marks another critical step towards delivering on the Company’s goal of building Australia’s next mid-tier copper powerhouse through disciplined consolidation, low-cost production, and responsible growth across Queensland’s world-class copper belt.

The Placement Offer provides Austral with an extended runway through key strategic milestones in unlocking the full of potential of the Mount Isa copper system, targeting sustainable production of 50,000 tonnes of copper metal per year for over 20 years. Importantly, it paves the way for Austral to be re-quoted on the ASX and for it to begin the journey of generating returns for shareholders.”

Strengthened Platform for Growth

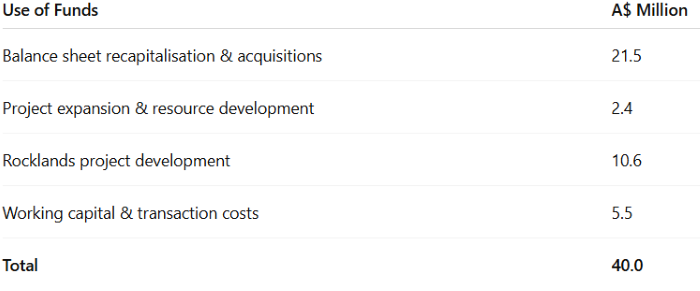

Proceeds will be directed towards balance sheet recapitalization and acquisition integration, exploration and resource development, the Rocklands Mine development, and general working capital. Austral’s recent acquisitions of Rocklands and Lady Loretta, combined with this raise, provide a strong foundation to unlock the Mount Isa copper system through consolidated ownership of regional infrastructure.

ASX Re-Quotation on Track

Austral has been suspended from trading since September 2023 and has been working closely with the ASX to satisfy all remaining reinstatement conditions. Following completion of the offer, Austral expects to meet these requirements and resume trading by 28 October 2025.

Placement Details

- Amount raised: A$40 million

- Issue price: A$0.05 per share

- New shares: Approximately 800 million

- Joint lead managers: Bell Potter Securities Limited and Shaw and Partners Limited

Funds will be allocated as follows: