Feb 24 2020

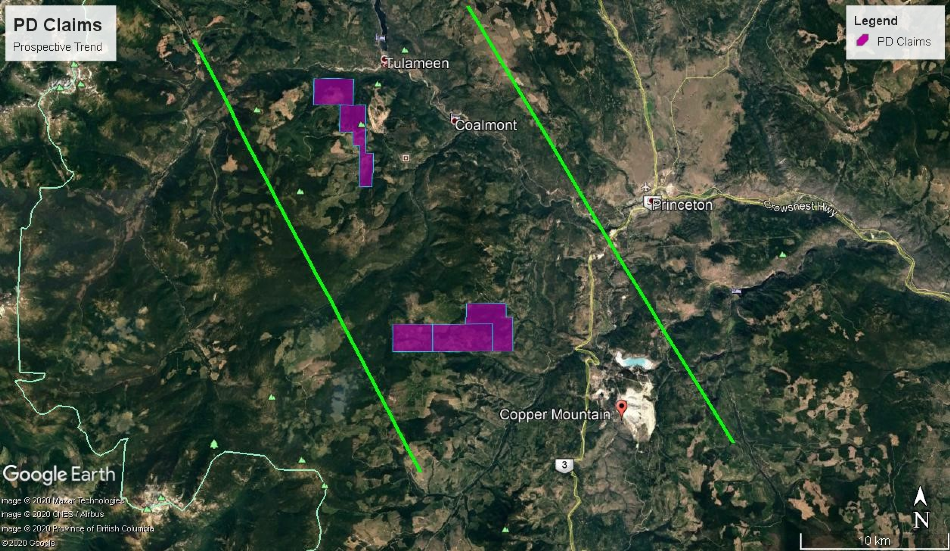

MegumaGold Corp. recently reported that it has given its consent to purchase five mineral claims encompassing 3067 hectares, in the Similkameen mining division, located about 7 and 20 km northwest of Copper Mountain.

PD Claims. Image Credit: MegumaGold Corp.

PD Claims. Image Credit: MegumaGold Corp.

This division exhibits the potential for platinum and palladium related to both the alkalic intrusives of the Okanagan.

Several PGE mineral occurrences are linked to alkalic intrusive porphyries like New Gold’s New Afton and Copper Mountain, both of which consist of major concentrations of platinum and palladium. The sulfide concentrate from the mine at Copper Mountain generated nearly 0.155 g/t platinum and 2.8 g/t palladium. A bornite-chalcopyrite vein sample obtained from the glory hole generated 3.25 g/t palladium (after Nixion).

The most recent resource estimate available from New Afton reports grades of (0.10 g/t) palladium. Both Copper Mountain and New Afton are within or preparing for large-scale exploration and expansion in the region. Recently, New Gold announced a substantial $460,000,000 exploration initiative to facilitate more discoveries, which would enable the extension of their New Afton mine life.

Megumagold is pleased to add to its BC land package which is strategically among large producers who have demonstrated high grade platinum and palladium from similar intrusives. The district at one time was the principal producer of palladium in North America.

Theo van der Linde, President, MegumaGold Corp.

Van der Linde continued, “Being Palladium is at an all time high and not expected to slow down, due to the recent realization of the massive shortfall of the metal, we feel Meguma has substantial means to aggressively explore the recent acquisition being the region and its geological setting is well known for palladium yet has been relatively under looked and underexplored.”

The Company plans to start surface work, mapping, and sampling on the claims immediately, to start preparing for a much wider scale work program. In the coming weeks, the company will start an aggressive sampling program to obtain samples for assay.

The claims will be purchased from arm’s length vendors taking into account the sum of CDN$125,000, as well as 6,000,000 fully paid and non-assessable shares contingent on submission of necessary filings and getting any required approvals from the Canadian Securities Exchange.

Why Palladium

The market trade value of Spot Palladium is as high as $2,829.75 per ounce, implying that at its peak, the metal cost approximately $275 above the old record high that was realized last month. Palladium, at the all-time high, was already up 46% for the year, until now, which was almost close to 2019’s gain of 54%. For many years, the market for palladium has faced an annual supply/demand deficit.

At the beginning of this month, Johnson Matthey published a report stating that last year, auto-related demand increased to a record-high 9.7 million ounces, despite the fact that auto sales fell in some countries. This led to the need for more palladium for each auto catalyst in certain regions, owing to more stringent emissions regulations. According to the firm, the 2019 deficit in supply was 1.19 million ounces and it was “likely to deepen in 2020.”

According to TD securities, “palladium is stealing the spotlight,” and “metal scarcity will likely continue to push prices higher.”