Jun 7 2021

Puma Exploration Inc. has provided an update on its current 2021 exploration program at the Williams Brook Gold Property in New Brunswick, Canada's Atlantic province.

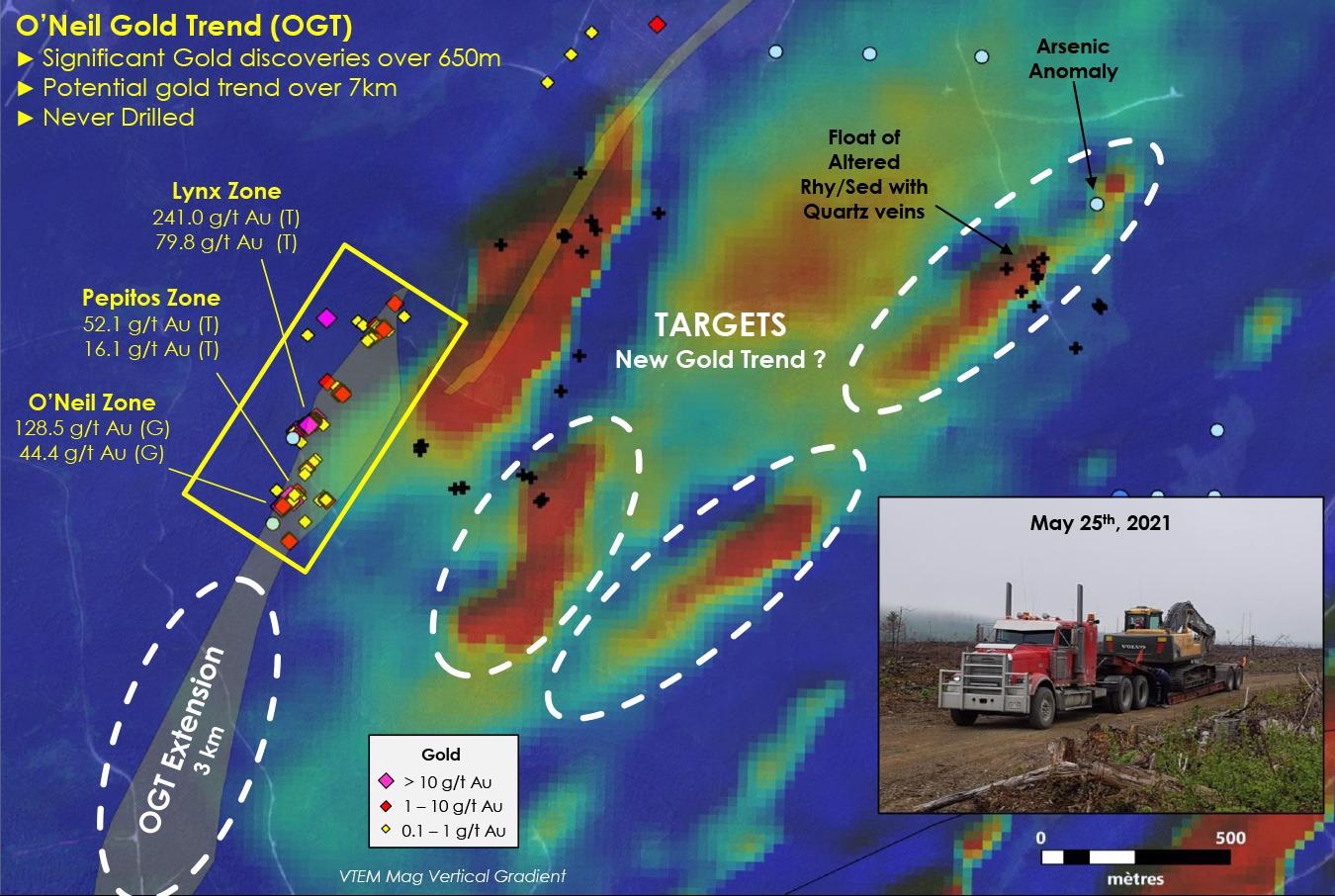

First Priority Target for 2021 Summer Exploration Program. Image Credit: Puma Exploration Inc.

First Priority Target for 2021 Summer Exploration Program. Image Credit: Puma Exploration Inc.

With three technical teams deployed on site, the summer field program is well underway. Heavy equipment for timber trenching, stripping and cutting has also been moved and is now active on-site.

The main goal present program is to detail and build on the recent large gold discoveries along the O’Neil Gold Trend (OGT), tracked more than 650 m with bonanza grades of up to 241.0 g/t Au. OGT will also look after particular work in preparation for the upcoming drilling program, which is scheduled to start in June 2021.

Major developments were made during the first two weeks of the program which includes:

- Wood cutting of a 200 m X 600 m area spanning OGT is 25% complete and should be finished by mid-June.

- OGT stripping has commenced and will continue when the wood cutting is completed.

- This effort will aid the PUMA technical teams who are mapping the gold-bearing quartz veins along the contact sediments-rhyolite.

- Drone tests are being conducted to correctly place the lithologies and structures with extensive photos of the whole OGT.

- The drilling locations for the first program (2,000 m) on the OGT have been prepared. Drilling is expected to begin before the end of June.

- Prospection of more than 50 priority sites identified in the recent big VTEM aerial survey is proceeding. This method has already been effective in discovering parallel sediment-rhyolite contact zones near the OGT.

The 2021 summer exploration campaign is a great milestone for Puma’s shareholders. It is the result of the long, hard, and dedicated work of our technical team since the acquisition of the Williams Brook Gold Property last year. And now we are very excited by the upcoming first drilling program on our recent OGT discovery, and anxious to see what OGT has in store for us!.”

Marcel Robillard, President and CEO, Puma Exploration Inc.

O’Neil Gold Trend (OGT)

The O’Neil Gold Trend (OGT) is a pervasive brecciated and altered rhyolite unit with large gold showings and occurrences followed by trenching across a 7.0-kilometer strike length.

The favorable unit (rhyolite) is comparable to and parallel to the structures that host the 'Williams 1' and 'Williams 2' Gold Zones, with chosen drill results of 11.2 g/t Au over 2.8 m, 2.1 g/t Au over 9.0 m and 1.0 g/t over 23 m.

These patterns are thought to be associated with a significant rifting event in New Brunswick, and they might represent a low sulfidation epithermal gold system.

The breadth of the changed horizon varies from 5 to 250 m along the OGT, with an average apparent thickness of 150 m. Numerous quartz veins, quartz veinlets, stockworks and breccias were discovered, most of which run perpendicular to the main trend and contain gold mineralization.

The OGT has never been drilled, however during the summer 2020 exploration effort, multiple gold zones were discovered.

High-grade selected grab samples assays on the prolific O’Neil Gold Trend (OGT)*:

Lynx Gold Area (VG): 241.0 g/t Au, 79.8 g/t Au, 74.2 g/t Au, 63.5 g/t Au, 58.4 g/t Au

O’Neil Gold Area (VG): 128.5 g/t Au, 44.4 g/t Au, 38.8 g/t Au, 32.8 g/t Au, 23.1 g/t Au

Chubby Gold Area: 3.5 g/t Au, 1.2 g/t Au, 1.2 g/t Au, 0.45 g/t Au

Moose Gold Area: 2.4 g/t Au, 2.1 g/t Au, 1.3 g/t Au, 1.1 g/t Au

Pepitos Gold Area (VG): 52.1 g/t Au, 16.1 g/t Au, 15.0 g/t Au, 13.1 g/t Au, 4.87 g/t Au

*Selected rock grab samples are selective by nature and may not represent the true grade or style

Modification of Exercise Price for Options Granted

Puma has changed the exercise price for the options issued on May 20th, 2021 from 25 cents to 26.5 cents following the regulatory (TSX-V) modification. The overall number of incentive stock options issued to the company’s directors, advisors and consultants remains at 1.6 million. These options are expected to expire on June 4th, 2023.