Challenger Gold Limited has executed an Investment Protection Agreement (IPA) with the Government of Ecuador for its 100%-owned El Guayabo Project—delivering critical legal and regulatory protections for one of South America’s largest undeveloped gold resources.

Image Credit: Challenger Gold Limited

The IPA covers US$75 million in investment by CEL, including historical expenditure since acquisition in 2019 and forecast development spend through to 2027. The agreement provides:

- Regulatory and fiscal stability

- Protection from future adverse legal changes

- International arbitration through the ICC in London

- Security of title and property rights

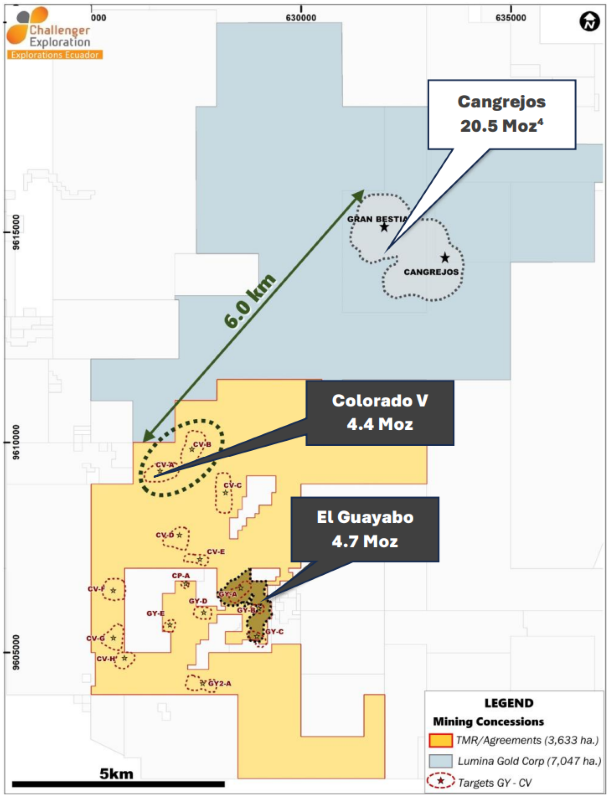

This 8-year renewable agreement provides Challenger with the confidence to advance monetization strategies for its Ecuadorian assets, which include a 9.1 Moz AuEq resource (6.9 Moz attributable) across the El Guayabo and Colorado V projects.

Challenger’s Managing Director, Mr Kris Knauer, commented:

“The completion of the Investment Protection Agreement is a significant development for the Project.

The IPA provides certainty with respect to the legal framework governing the Project, including stable mining regulations and fiscal terms, and security of title and investment for the term of the agreement.

Additionally, it provides protection from all forms of confiscation and a mechanism for international arbitration should there be any disputes related to the project.

The IPA is also timely given recent corporate action in Ecuador as we take steps to monetize our Ecuador assets following the significant resource upgrade from 4.5 million ounce¹ to 9.1 million ounces.”

Recent activity in Ecuador’s mining sector highlights growing interest in the region’s scale and prospectivity. Notably, Lumina Gold Corp’s Cangrejos Project—located adjacent to CEL’s tenure—was recently subject to a C$581 million takeover by CMOC Group.